The Role of Blockchain in M&A Intellectual Property Management

The landscape of mergers and acquisitions (M&A) has always been fraught with complexities, particularly when it comes to the management of intellectual property (IP). In this evolving ecosystem, blockchain technology emerges as a revolutionary tool that promises to streamline the tracking and verification of IP transactions. By offering a decentralized and immutable ledger, blockchain can significantly enhance transparency, reduce fraud, and foster trust among stakeholders.

Integrating blockchain into the realm of intellectual property management offers a multitude of advantages that address the traditional challenges faced in M&A transactions. These benefits can reshape the way businesses approach IP transactions, providing a solid framework for accountability and efficiency.

- Enhanced Transparency: Blockchain’s transparent nature allows all stakeholders to view and verify IP ownership and transaction history in real-time.

- Immutable Record Keeping: Once data is recorded on the blockchain, it cannot be altered, reducing the risk of disputes over IP ownership.

- Streamlined Processes: Smart contracts can automate and expedite transactions, reducing the time and cost associated with traditional methods.

- Increased Trust: The decentralized nature of blockchain fosters trust among parties involved in the transaction, mitigating concerns over data manipulation.

To illustrate the transformative impact of blockchain in IP management during M&A, it’s essential to compare traditional practices with blockchain-enabled approaches. The following table outlines key differences:

| Aspect | Traditional IP Management | Blockchain-Enabled IP Management |

|---|---|---|

| Ownership Verification | Relies on centralized databases prone to errors | Utilizes a decentralized ledger for real-time verification |

| Transaction Speed | Can be slow and cumbersome due to paperwork | Smart contracts facilitate instant transactions |

| Security | Vulnerable to data breaches | Inherently secure due to cryptographic methods |

| Cost | High administrative and legal costs | Reduced costs through automation and efficiency |

As the M&A landscape increasingly embraces technological advancements, blockchain stands out as a promising solution for managing intellectual property transactions. Its potential to provide transparency, security, and efficiency makes it an indispensable tool for businesses looking to navigate the complexities of M&A with confidence.

Enhancing Due Diligence Through Blockchain Technology

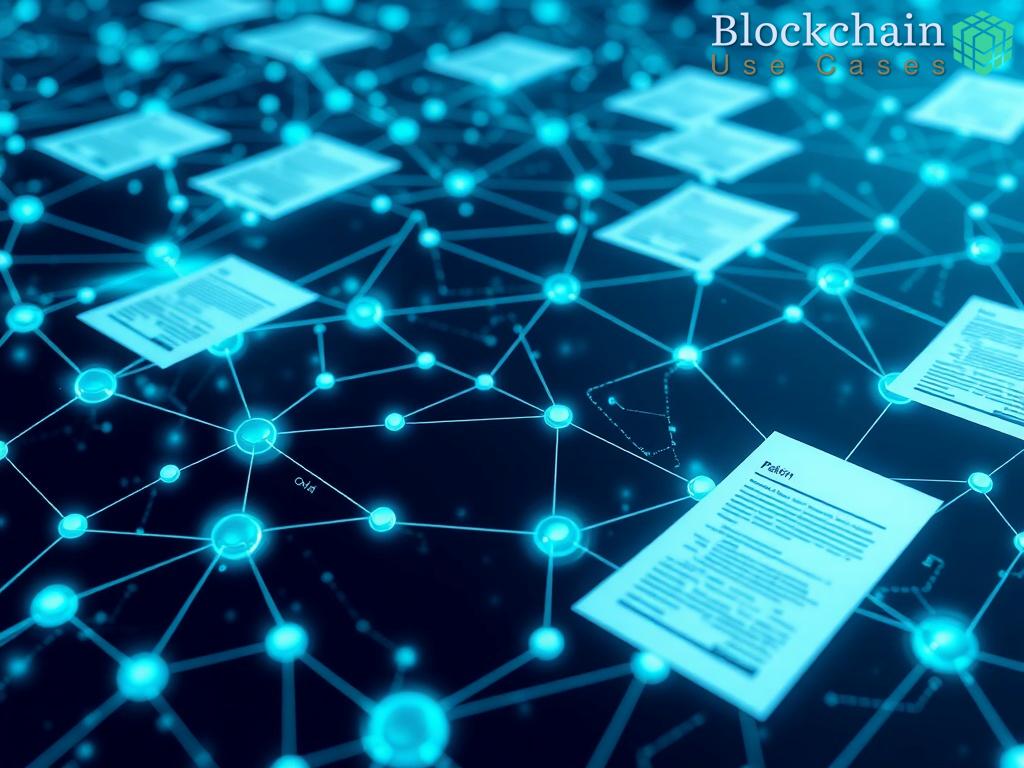

The process of due diligence in M&A transactions is crucial for assessing the value and risks associated with a company’s intellectual property. Traditional methods often involve extensive documentation and can lead to inefficiencies and inaccuracies. However, with the integration of blockchain technology, the due diligence process can undergo a significant transformation, ensuring greater accuracy and reliability in IP assessments.

One of the primary advantages of utilizing blockchain for due diligence is its ability to provide real-time access to verified data. Stakeholders can instantly access a comprehensive history of IP ownership, including previous transactions and any associated rights or encumbrances. This immediate transparency not only accelerates the due diligence process but also enhances the reliability of the information being reviewed. By ensuring that all parties have access to the same information in a secure and immutable format, blockchain reduces the potential for disputes that could arise from differing interpretations of IP rights.

Moreover, the use of smart contracts further elevates the due diligence process by automating compliance checks and ensuring that all contractual obligations related to intellectual property are met before any transaction occurs. This proactive approach allows for the identification of any potential issues before they escalate, effectively minimizing risks associated with the acquisition of IP assets. Additionally, as these contracts are executed on the blockchain, they are inherently secure, reducing the likelihood of fraud or misrepresentation.

In an era where the value of intellectual property can be a decisive factor in M&A negotiations, leveraging blockchain technology for due diligence not only enhances efficiency but also builds trust among stakeholders. The transparent nature of blockchain fosters confidence in the transaction, as all parties can independently verify the integrity of the data without relying solely on third-party intermediaries. This shift towards a more collaborative and transparent environment is essential for modern M&A strategies.

Smart Contracts for IP Rights in Mergers and Acquisitions

The integration of smart contracts into the management of intellectual property (IP) rights during mergers and acquisitions (M&A) represents a significant leap forward in how companies can secure and enforce their IP assets. As organizations increasingly seek to leverage their intangible assets for competitive advantage, the role of smart contracts in facilitating seamless IP transactions cannot be underestimated. These self-executing contracts, built on blockchain technology, not only enhance operational efficiency but also provide a robust framework for ensuring compliance and reducing the potential for disputes.

One of the most compelling features of smart contracts is their ability to automate various aspects of IP transactions. By embedding the terms of an agreement directly into the code, smart contracts can trigger specific actions once predetermined conditions are met. For example, in an M&A scenario, when a buyer meets agreed-upon financial thresholds, the smart contract can automatically transfer IP rights to the buyer without the need for intermediaries. This automation not only accelerates the transaction process but also minimizes human error, thereby safeguarding the integrity of the IP transfer.

Furthermore, the transparency offered by blockchain technology enhances the trustworthiness of smart contracts. All parties involved in the transaction can access the contract and monitor its execution in real-time, ensuring that everyone adheres to the agreed-upon terms. This transparency is particularly crucial in M&A deals, where the stakes are high and the potential for misunderstandings can lead to costly legal disputes. By eliminating ambiguity, smart contracts encourage a more collaborative environment among stakeholders, fostering stronger relationships and facilitating smoother negotiations.

Additionally, smart contracts can play a pivotal role in the ongoing management of IP rights post-acquisition. They can be programmed to include clauses related to royalties, usage rights, and other obligations that may extend beyond the initial transaction. For instance, if an acquired IP asset generates revenue, a smart contract can automatically allocate royalty payments to previous owners or stakeholders based on predefined conditions. This capability not only ensures compliance but also enhances the value of the IP asset by establishing clear revenue-sharing mechanisms.

As the landscape of M&A continues to evolve, the adoption of smart contracts for managing intellectual property rights is becoming increasingly prevalent. Companies that leverage this innovative technology are not only positioning themselves at the forefront of industry advancements but also enhancing their operational resilience. By embracing smart contracts, organizations can unlock new efficiencies, foster greater transparency, and ultimately drive more successful M&A transactions.

Challenges and Solutions in Implementing Blockchain for IP Tracking

The integration of blockchain technology in tracking intellectual property (IP) transactions during mergers and acquisitions (M&A) presents exciting opportunities but also significant challenges. As organizations seek to enhance transparency and efficiency, understanding these hurdles is crucial for successful implementation. Addressing these challenges head-on not only mitigates risks but also paves the way for a more robust framework for IP management.

Implementing blockchain for IP tracking is not without its obstacles. Organizations must navigate technical, regulatory, and operational challenges that can impede the seamless integration of this innovative technology. By pinpointing these barriers, businesses can develop strategic solutions tailored to their unique circumstances.

- Technological Complexity: The technical intricacies of blockchain can be daunting for organizations new to the technology. Integrating blockchain with existing systems requires specialized knowledge and resources.

- Data Privacy Concerns: Stakeholders may worry about the confidentiality of sensitive IP information on a transparent ledger, leading to resistance in adopting blockchain solutions.

- Regulatory Compliance: The evolving legal landscape surrounding blockchain and IP rights can create uncertainty. Organizations must ensure compliance with local and international laws to avoid potential legal pitfalls.

- Organizational Resistance: Change management is another challenge, as employees and stakeholders may resist adopting new processes and technologies. This cultural shift requires careful navigation.

To harness the full potential of blockchain in IP tracking, organizations can adopt various solutions aimed at overcoming identified challenges. By proactively addressing these issues, businesses can create a conducive environment for blockchain adoption, ultimately enhancing their M&A strategies.

- Invest in Training and Development: Providing comprehensive training to employees on blockchain technology can demystify its complexities and empower teams to leverage its benefits effectively.

- Implement Data Encryption Protocols: Utilizing advanced encryption techniques can alleviate data privacy concerns, ensuring that sensitive information remains confidential while still benefiting from blockchain’s transparency.

- Engage with Legal Experts: Collaborating with legal professionals familiar with blockchain and IP law can help organizations stay compliant with evolving regulations and mitigate legal risks.

- Foster a Culture of Innovation: Encouraging a culture that embraces change and innovation can facilitate smoother transitions to blockchain systems, reducing resistance and enhancing collaboration.

In conclusion, while the challenges of implementing blockchain for tracking intellectual property transactions in M&A are significant, they are not insurmountable. By understanding these barriers and actively pursuing tailored solutions, organizations can position themselves to reap the benefits of enhanced transparency, efficiency, and trust in their IP transactions.

Future Trends in Blockchain for Intellectual Property Transactions

The adoption of blockchain technology in the management of intellectual property (IP) transactions is set to reshape the landscape of mergers and acquisitions (M&A) in profound ways. As we look to the future, several emerging trends are likely to enhance the effectiveness of blockchain in ensuring transparency and security in IP dealings. These trends signal a significant shift in how businesses not only protect their assets but also engage in strategic transactions.

Decentralized Autonomous Organizations (DAOs) are predicted to play a crucial role in the future of IP transactions. These organizations leverage blockchain to automate decision-making processes, allowing for collective ownership and governance of IP assets. By facilitating a more democratic approach to IP management, DAOs can empower stakeholders, enhance collaboration, and streamline the execution of licensing agreements. This innovation not only democratizes IP ownership but also reduces the complexities involved in traditional governance structures.

Another trend on the horizon is the integration of Artificial Intelligence (AI) with blockchain technology. Combining these two powerful technologies can revolutionize the way IP transactions are managed. AI can analyze vast amounts of data to assess the value of IP assets, identify potential infringements, and facilitate predictive analytics for future transactions. When paired with blockchain’s secure and transparent framework, businesses can achieve higher accuracy in IP valuations and risk assessments, thereby making more informed decisions during M&A activities.

Moreover, the rise of Interoperability Standards for blockchain networks is expected to enhance collaborative efforts across industries. As various blockchain platforms emerge, establishing common standards will facilitate seamless data sharing and communication between different systems. This interoperability will be essential for creating a unified ecosystem where stakeholders can efficiently manage IP rights across multiple jurisdictions, thereby minimizing legal complexities and enhancing compliance.

In conclusion, the future of blockchain in IP transactions for M&A is bright, characterized by innovations that promise to elevate transparency, efficiency, and trust. As organizations continue to explore these advancements, embracing a forward-thinking mindset will be crucial in navigating the evolving landscape of intellectual property management.